Bridge Fund

An enterprise CRM application to manage funds across high profile projects while growing communities and delivering returns to the investors

This application is designed to help the effectiveness and success of Bridge Funding. The secure cloud-based CRM and capital-raising capabilities, coupled with a dynamic, secure Investor & Manager portal, ensure that every interaction between both the parties drives satisfaction, loyalty, and retention. It is a massive transformation from the current manual workaround to a robust digital space saving time and efforts.

MY ROLE

Lead and solo Designer – Discovery, user research, design and prototyping, Usability/Functionality Testing

YEAR

2020 - Current

TOOLS

Adobe XD, Invision, Sketch, Adobe Photoshop

WHAT IS BRIDGE FUND?

Bridge Funding is interim funding used for a business's short-term expenses until longer-term funding becomes available. A bridge loan may be a viable option for a business owner who needs money quickly to operate their business.

A bridge loan is typically approved more quickly than a bank-issued loan since they are offered through private lenders.

The process of applying, getting approved, and funding bridge loans is typically faster than with traditional loans. Nevertheless, these loans often come with short terms, high interest rates, and large origination fees in exchange for the convenience. Generally, borrowers accept these terms because they require fast, convenient access to funds. The high-interest rate is acceptable to them since they know the loan will be short-term and that they will pay it off with low-interest, long-term financing soon. Bridge loans generally do not impose penalties for early repayment.

PROBLEM

An ideal workflow and development of a digital product are essential to help the Bridge Manager optimize the workload of fund management by handling the project requests and generating the required funds in addition to managing and collaborating with the investors and borrowers for a harmonious experience.

FUND MANAGEMENT

DIGITAL TRANSFORMATION

Bridge Fund management requires cohesive collaboration between the borrower who is in need of immediate funds and a set of investors who are ready to lend the required amount. The Bridge Fund manager who is a mediator in the process needs an application to manage the workflow revolving around both parties. Externally, the bridge manager has to arrange for the dispersal of funds at the right time and manage the requests for the new projects. Hence there is a need for a system to help with the workflow management

Currently, the workaround uses Excel spreadsheets to store the different cycle data and manipulations. The communication between the lender and Manager is carried via Gmail and text messages. This type of approach is

More dependent on a user to handle all requests and calculations. This room for redundancy increases the error rate

Reliant on third party service providers like Gmail, Spreadsheet throughout the workflow

As Bridge Funding involves heavy financial transactions, communication between parties without a proper secure channel increases the risk

The status of the cycle and notifications require multiple emails to be sent and received which emphasizes the lack of a proper workflow and also a heavy overhead

As lot of contacts are added as investors, there becomes a necessity to set the system for scalability and also find a way to validate the lender profile

As the system expands and more managers are added to the system, the manual workflow becomes tedious and there might be privilege distress causing the system to behave in a chaotic way.

Hence it is necessary for the existing system to move towards a more scalable, secure, and less-chaotic digital environment which would reduce the workload by half.

Features of the

Application

Highly secure point of access for the Lender

Lender Portal

The lender portal is a web-based cloud powered interface which helps the approved investors to view the upcoming cycle information and also create a point of contact between the lender and the manager

Indicate intention to participate and pledge amount

Proof of Deposit for every amount pledged to build trust

Request withdrawal against specific Bridge cycle

Automated notifications for any cycle status changes

Receive and counter-sign the promissory note for every transaction automated through e-signatures

Build a lender profile for identity and validation

Secure hub to manage the cycles and contacts

Manager Portal

The cloud-based web interface helps the manager to access data and organize the fund management actions of the lender

Review the new lender requests and manage existing lenders

Take control of the Fund flow by creating and managing cycle data

Flagging lenders not honoring the amount pledged at any point

Issue promissory note for every transaction and get it signed digitally and securely

One click action to change the status of the lender or the cycle

Review, Approve and Control the withdrawal requests for every due cycle

OUR VISION

To create a seamless yet non-overpowering transition from the manual workaround to a semi-automated CRM application to aid the target users with Fund management

The

Design Process

RESEARCH

Following a direct interview with the client, we brainstormed the basic requirements. There was a manual working system in place and the workflow has to be transformed into a semi-automated structure. Our first point of entry into research was to understand the working of Bridge Fund and the pain points of the system. To digitally transform the spreadsheet entry process, we had to ear-mark the areas of the existing flow. We segregated the system into 3 major components to start the research – Lender View, Bridge Manager View, and Lender Approval. The end-product would be a seamless aggregation of the three workflows.

The project was a combination of modules – Fund Management, Contact Management, Contract Management, CRM. We had to draw inspiration from distinct applications covering these aspects to analyze the project. After the initial exploration, we obtained an overall picture of the challenges of Digital Transformation, the Risk impact of Fund Management, and Workflow Automation on the business level. The idea is to build a robust, learnable, and scalable system which would accommodate more lenders and contracts in the future.

We collaborated with the end-users in all the research sittings to finalize the workflow. The requirements underwent many iterations but we were able to nail the MVP and list the features to kick-start the initial product design.

02

User Stories

We classified the user stories based on the top features we needed to include in the app

We segmented the features based on the business impact and cost. This helped us to structure the MVP for the first release.

Target

Users

Inspiration

We took references from different financial websites, CRM applications, screenshots from existing working applications, dribble to generate an idea of designing the system.

We followed the atomic design strategy to design the atoms, components, patterns from the inspiration shots and mapped them to the workflow of the Bridge Fund process.

CONSTRAINTS

Digital Transformation of the entire workflow is not fulfilled in the first release. We wanted to retain some of the manual aspects of the project so that the change management is not overwhelming to the users. Also, The application is only suited for the web and is not mobile-friendly at this time. The credentials for Bridge Manager to login is limited to only 2 users and will be increased in later releases

User Journey

Feature Set

Based on the research and the bridge Fund process, We listed the major features which are essential to the workflow and added secondary features which will enhance the user experience. As we were given a tight time and budget deadline and also since the project was the first of its kind in the process automation arena, we restricted the MVP to fit in only the primary features.

By categorizing the features by impact and business value, we were able to sort the features. The matrix helped us plan for the features that would be developed for the subsequent releases.

DESIGN

Once we finalized the high-level process workflows and target user characteristics, we started with the initial sketches. There are 3 parts to the design - Lender Portal, Manager Portal, and Lender Approval flows. Once each of the individual Workflow was complete, we had to tie together the parts and test the validity of the flows between the Lender and Bridge Manager’s end.

This workflow design was the first of the kind and hence we had to draw inspiration from different connected applications such as Bank websites, CRM, Fund Management. Since the goal was to replicate most of the functionalities of managing data in Spreadsheet to the end application, we had to retain the spreadsheet structure while digitally transforming the process of manually entering data in some columns.

Many iterations of sketches were done before we transformed the sketches to low-fidelity wireframes. Though the login screen was decided to be the same for both the lender and Bridge Manager ends, We had a separate view of the Dashboard for the lender and Manager. The registration flow design was only applicable to the lender flow and it consisted of multiple steps to collect the information for submission to the Manager. We brainstormed the different cards which the manager would want to visualize on the Dashboard. The manager dashboard had separate sections – Contacts, Contracts, Cycles of which the fields and layout pertaining to each section were designed. The interactions between both ends – Approval/Rejections were determined by the status change which was finalized as the next step. The fields on the tables to be automated and retained as manual entries were listed. “Flexible yet no room for error” was the intent to be satisfied while deciding the Edit functionality of the fields.

Once the color palette and the style guide were finalized, we transformed the low-fi wireframes into high-fi ones. We used a simple color palette to distinguish the active and inactive state of the cycles. Once the initial prototype was released to the client, based on the initial feedback, we performed a series of design iterations before it was passed on to the development team and finally geared for release.

03

Moodboard &

Branding

SETTING THE COLOR TONE

Over half of the top fifty financial services brands have blue logos and another seven have blue elements in their logos. Since the Bridge Fund project basically involved the aspect of money, we wanted the branding and color palette to reflect imply stability, integrity, and trust. Also, since there were entries that involved numerical figures, we needed a crisp color against a white background. We researched the branding and mood board of some of the top finance websites, which finally led to using the traditional blue-gray-white palette.

Wireframes

Sign Up Selection

Add a contract - Step 1

List of Documents

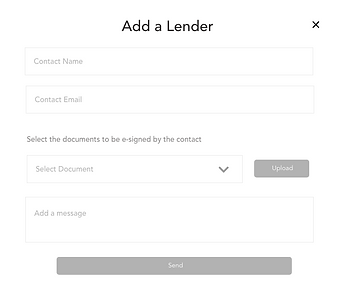

Add a Lender

Add a contract - Step 2

Manager Portal updated

List of Contracts

Add a contract - Step 3

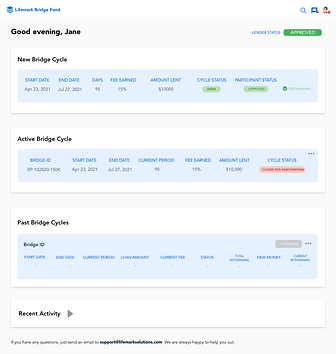

Lender Portal

Lender Portal - Design Changes

v 1.0

Current Bridge cycle to indicate a clear status rather than highlighting the available status

Need to display Active Bridge Cycle and draw a clear line between the participation cycle and the cycle in progress after activation

Button placement to be consistent with the rest of the design

v 2.0

v 3.0

Recent activity does not have a business value to the MVP at this time. Hence removal of the section

Removing the cycle status as its a redundant information

Separating past bridge cycle section as Due Bridge and past bridge to distinguish the cycle in which the money can be withdrawn vs the cycle which has crossed its end date.

Keeping the Lender side consistent with the Bridge Manager’s view. Hence display of the New Money cycle and the rollover cycle would suffice.

Past and completed cycles are a part of the cycle history which is moved to the next release

v 4.0 - Final Design

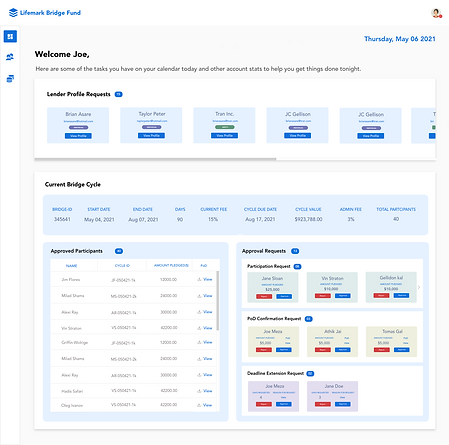

Manager Portal - Design Changes

v 1.0

v 2.0

v 3.0

Lenders pending Approval must be prioritized and moved before the overall stats

Each bridge cycle has separate approval status at each stage of the process and the dashboard has to reflect the lenders under each status

Bridge manager must be given the ability to handle approval/rejection requests on the Dashboard without navigating to the key flows

Analytics can be added as a part of the next cycle - Not a critical Requirement

Overall Status of the cycle should be displayed on the Dashboard

Change of the Navigation placement to avoid crowding in the header space

Addition of the number tag to mark the number of lenders, contracts to give more clarity

Additional Stats to provide more information to the manager as the overview

Section needed to approve the deadline extension of the lenders. Added under the current bridge cycle

Removal of calendar, Document, Settings section for a minimal design approach which ticks only the most sought requirements in the MVP

Bridge cycles in due state can be moved to the inner section since it provides less value on the Dashboard

v 4.0

When the requirement of the client changed for the project to include more than one current cycle, the dashboard view was even simplified to only include the contacts and cycles as 2 separate tabs. The navigation was removed or in other words simplified to include only 2 key sections

The focus was on the working of the cycle (Current, Rollover) and hence overall stats were removed and the dashboard was re-designed to delve straight to the process.

The frequency of lender requests was limited and hence removing it would not impact the user experience

v 5.0 Final Design

Key features - Lender Management and Cycle Management as separate sections

Settings and profile information moved to the right corner of the screen

Ability of the Bridge Manager to control the cycle participation and also view the lenders under each cycle - Flexibility and Spreadsheet view satisfies user’s goal

New requests are moved under the Lender section and the manager can approve or reject the request

Bridge Fund Workflow

Prototype

Manager Portal

Lender Portal

DEVELOPMENT, RELEASE & TESTING

Version 1 of this application is under testing and all set to release early next year. Right now, Our team is performing extensive functionality testing of the application before the first release. Since this project involves real currency calculations, We want to make sure that all the flows are handled flawlessly so that the system is robust and reliable.

04

We selected a test set of lenders who would be the participants for usability testing of the live application – one step before the final release. After the release, the first step would be to register and approve all the existing lenders and establish the learning path for the application. The later step would be to open the application for the new lenders who are the first users of the process.

OUTCOME

This was a super challenging area to work on. The project was my first foray into designing financial interfaces. We had no competitive applications to draw the inspiration in terms of workflow, UI components, and layouts. Hence, we had to research different applications which served a similar purpose and build the base of the project. Further, the design involved interaction of CRM + Fund management + Digital Transformation modules which involved numerous iterations to perfect the flow. We stuck with implementing the minimal viable product for the first release and planned to add other features in the subsequent releases. The key takeaways from this project are

05

Consistent Design is Intuitive Design

Consistency increases the learnability and usability of the interfaces. Visual consistency was established in terms of using a similar color layout for both lender and Bridge manager interfaces with similar cues to active and inactive cycles. Though the manager view can have a deeper depth of the cycle view, Functional consistency was considered when displaying the same cycle views and usage of similar terminologies for both the manager and the lender.

Change Management is a barrier when it comes to Digital Transformation

When an organization is moving from a manual process to a full-fledged digital environment, it is difficult for the members to understand and embrace the change. At each major step of the digital transformation, we had to get the client feedback and the challenge was to establish a baseline where the organization is not overwhelmed with the application but also understands the need for the change. The user experience must be intuitive that the users are satisfied that the manual workload is cut by 3x times when operating the application. Thus, it was imperative that a workflow be designed in such a way that the process is more accessible to those who weren't so technologically savvy.

Design of Financial CRM involves solving the obvious Risk Management goals

As the design for the Finance related CRM involves aspects like Data consistency, contact management, contract management, High fund transaction information, increasing the complexity of the system by including unwanted components will increase the risk of the functionality while also compromising the user experience. If the employees cannot achieve their goals through CRM, they might begin to fall back to the old process nullifying the utility of the system. Hence a minimal design to realize the functional requirements of the system + proper communication with the end-users from time to time will reduce the risk of obsolete CRM

ENHANCEMENTS

While we were able to accomplish 70% of functional digital transformation, few communications had to be carried out externally. In future releases, we want to move towards achieving more automation and reduce the workload

Calendar Integration

Adding calendar functionality to the application will help the users to be aware of the cycle schedules and to be more informed about the deadlines. Adding reminders as a part of the integration gives up-to-date notifications of the status of the cycle and be prepared for withdrawal and rollover period

Trends for the cycle details

The addition of analytics to represent the cycle trends, contact addition trends, total money collected, total money withdrawn, gives an insight of the system performance and will help the bridge manager and the lender to make informed decisions about fund management.

Access privileges for different users

Adding access privileges to users on the Bridge manager’s end would help the Administrator to delegate the cycle responsibilities to different managers under him so that the workload is split

Activity History of the cycles

Once a cycle is completed, retaining a snapshot of the cycle details and the rollover history informs the users about the history of their pledged amount and the withdrawals.

Chatbot for two way communication

In this release, The communication channel between the lender and the Bridge manager is through email which is outside the scope of the system. Future releases would require the addition of an internal chatbot to cater to the lender’s queries without the need for an external system.